In algorithmic trading, success hinges on managing risks, not just chasing profits. A key risk metric to grasp is drawdown, the temporary drop in an algorithm’s performance from its peak. Whether you’re a veteran trader or new to Algo Pilot, our no-code platform simplifies monitoring and mitigating drawdowns, enabling you to craft resilient trading strategies. This post breaks down drawdowns, showcases how Algo Pilot’s analytics and backtesting tools deliver actionable insights, and shares a hypothetical story of a user refining their algorithm to curb losses.

Drawdowns measure how far an algorithm’s performance falls from its highest point before recovering. Picture it as the dip your strategy endures during tough market moments. Maximum drawdown captures the largest peak-to-trough decline, like a $10,000 value dropping to $9,000 for a 10% loss. Large or frequent drawdowns may signal a need for tweaks to ensure sustainability.

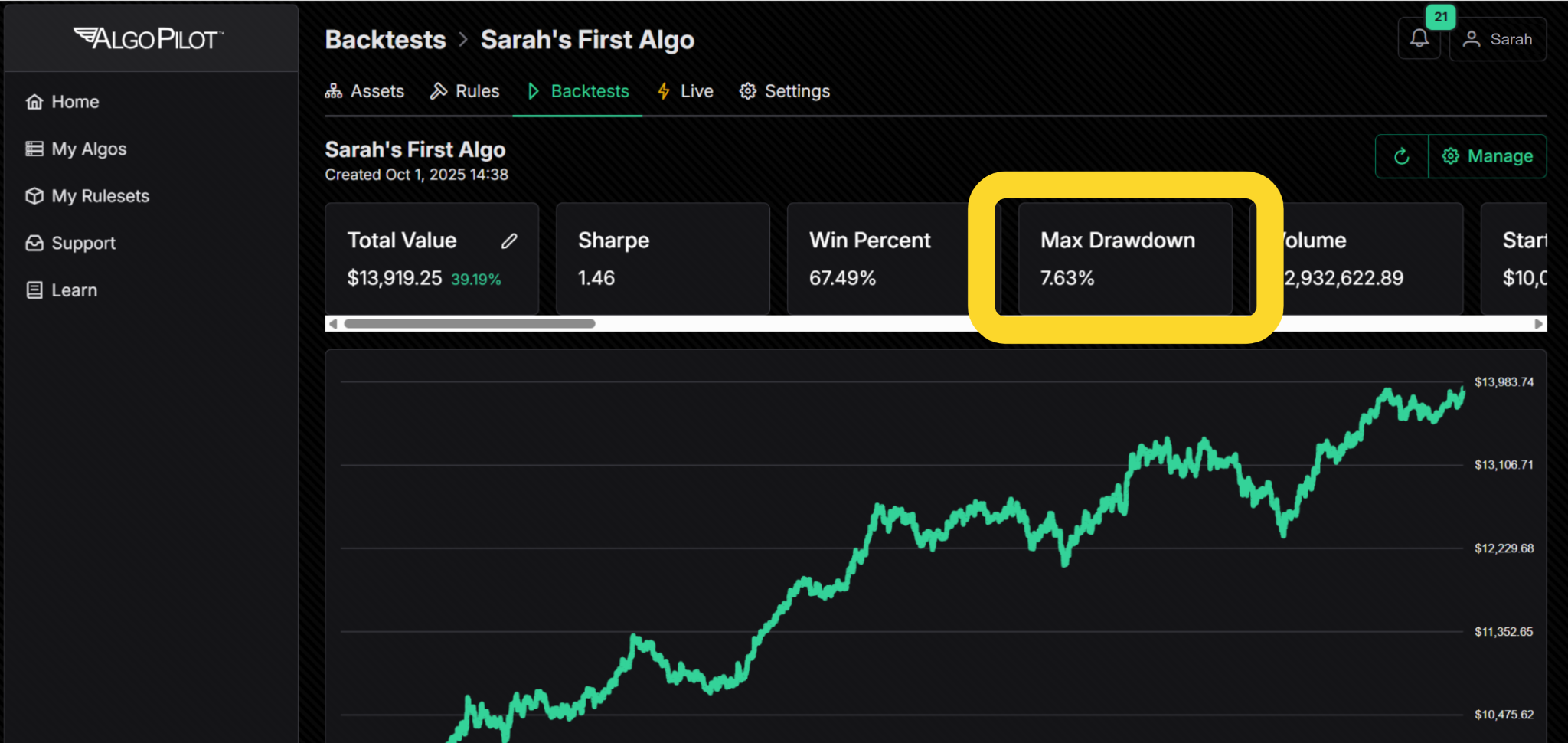

Algo Pilot’s performance dashboards and backtesting tools provide clear insights into your algorithm’s behavior, by displaying Max Drawdown (along with more than 20 other metrics) with every backtest that you run. You can instantly see how much your strategy dipped during a test period and compare performance across market conditions. Backtesting lets you simulate algorithms against historical data for assets like SPY, QQQ, or BTC. With the new Broker Fees Integration (find it in Account>Preferences>Fee Model), you can include trading costs for a realistic drawdown view, such as testing performance during the crypto volatility of 2022. Adjustable timeframes let you analyze drawdowns over weeks, months, or years, helping you spot patterns. By pairing drawdowns with metrics like returns and trade frequency, you can get a better estimation of potential trading risk.

Drawdowns are part of trading, but Algo Pilot’s no-code tools help you refine algorithms to minimize losses. High-frequency algorithms can increase fees and deepen drawdowns in choppy markets. Adjusting entry and exit conditions in Algo Pilot’s rule builder, like setting stricter moving average thresholds, can reduce overtrading. Adding stop-loss rules, such as exiting trades down 2%, limits losses on individual positions.

Backtesting across bullish, bearish, and sideways markets reveals drawdown spikes, allowing you to adjust position sizing for volatile periods. Using the Broker Fees Integration to model commissions ensures drawdowns reflect real-world costs, optimizing net performance.

Sarah, a hypothetical part-time trader, uses Algo Pilot to build and test algorithms for equities like AAPL. Her trend-following algorithm performed well in backtests but showed a 25% maximum drawdown during a volatile 2023 market period. Using Algo Pilot’s tools, she took action. First, she checked the performance dashboard after a backtest, where the maximum drawdown metric revealed overtrading during short-term price swings. Next, she used the rule builder to adjust her algorithm, requiring a 50-day moving average to cross the 200-day moving average, cutting trade frequency by 30%. She enabled the Broker Fees Integration (in her Account>Preferences>Fee Model) to factor in her broker’s per trade commission, uncovering fee-driven return erosion. After re-running the backtest, her maximum drawdown fell to 12% with better net returns. Sarah deployed the refined algorithm confidently. (Note: these numbers are for illustration purposes only and are not investment advice).

Managing drawdowns is vital for algorithmic trading success. Keeping drawdowns low protects capital, ensures consistent performance, and boosts trading confidence. For more on risk management, read our post, "Top 10 Risk Management Tips for Algorithmic Traders". To explore backtesting, check out "Backtesting: Why It’s Crucial for Algorithmic Trading Success".

Ready to master your algorithm’s risks? Sign up for Algo Pilot’s free plan to explore our performance dashboards and backtesting tools. Visit Algo Pilot to build smarter, more resilient trading strategies today.

Algo PilotTM is a US based technology company and not a bank, broker-dealer, or RIA. As such, Algo Pilot LLC does not provide investment advice and is not a member, SIPC. Brokerage services offered by 3rd parties are not directly affiliated with Algo Pilot LLC, and Algo PilotTM users may choose the broker relationship that they desire. Algo Pilot's Algo Builder is Patent Pending with the USPTO.

Past performance, whether actual or indicated by historical tests of strategies, is not a guarantee of future performance or success. Investing in stocks, futures, options, currencies, cryptocurrencies, and other financial vehicles involves risk. Investing in securities involves potential loss of principal. Trading in options or security futures involves a high degree of risk and investors may lose more than their initial investment; options trading is not suitable for all investors. Before trading, please read all applicable risk disclosures such as Characteristics and Risks of Standardized Options disclosure from your broker.